Table of Contents

Should you participate in your employer’s 401k plan? In principle, yes. As long as your employer offers to opt into a retirement plan — and you can afford the payments without putting your finances in jeopardy — you should jump in. Of course, we’re not going to lie to you: There are pros and cons to the 401k plan, which means that not everything will be rosy.

However, we cannot deny that 401k retirement plans are often one of the most important and popular savings methods in the United States. Therefore, if you are lucky enough to work in a company that offers it, you should not miss it.

Table of Content

- What is a 401k plan? in simple words

- Advantages of 401k Plans

- Disadvantages of Employer-Sponsored 401k Plans

- Self-managed 401k plans

What is a 401k plan? in simple words

A 401k plan is a retirement savings program that is usually employer-sponsored. Through it, American workers can plan their finances for the time of their retirement. 401k plans are made up of contributions that are made before taxes. Currently, 401k plans are the most widely used schemes in the country.

Note: If you are self-employed you can also access a similar program. There are many financial institutions that offer 401k accounts. In this case, what would change is that only you will make the contributions (not your employer).

One of the immediate benefits of 401k plans is that you can make each of your contributions before taxes. This will reduce your tax base, that is, that part of your annual income that is taxed with federal taxes. Therefore, your annual tax bill will be much lower and easier to pay (and that money you save on taxes will be earning interest in the meantime).

Advantages of 401k plans

There are several options within 401k plans. Generally, employers hire a financial company that is responsible for making the investments and creating a portfolio for the workers. The second option -which we will see later- is to self-manage the plan, but we will talk about its pros and cons. For now, let’s focus on what makes the employer-sponsored 401k plan special :

You will have federal protection

Employer-sponsored retirement plans are protected by the Employee Retirement Income Security Act , known as the ERISA Act of 1974. This federal law sets minimum standards for plan operation and administration. This will give you the right to, for example, sue the administrators if the funds are not managed correctly.

Your funds will be protected from your creditors

Suppose you have an outstanding debt and you lose your job. Your creditor may try to force payment through a lawsuit, but you should know that your 401k plan will not be available to them. Of course, there are some exceptions. To learn more, be sure to read our guide “Can my husband or wife take away my 401(k)?”.

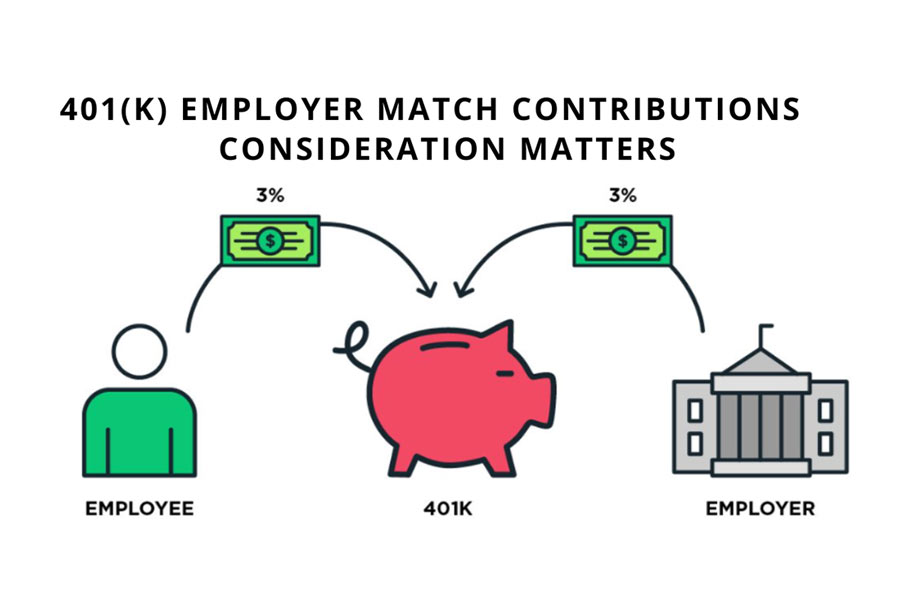

Your employer will match your contributions

Many employers that offer 401k plans agree to make a matching contribution from their employees. What does that mean? That will match 100% the amount you contribute per year. Let’s say you give up $1,000 every year to put toward your retirement program. Then your employer will make an additional $1,000 contribution. The good thing about this is that you will now have $2,000 invested earning interest.

You will be able to raise contributions in the future

By 2021, if you’re over 50, you can contribute more than $19,600 to your 401k retirement plan. How much are we talking about? From $26,000.

You will get free investment advice

Most 401k plan providers are large investors and have various educational resources available for workers. Take this opportunity to learn about the market. Perhaps in the future, you can manage your fund on your own.

You will defer the payment of part of the income tax

And it is that, the contributions you make to your plan will be tax-free and you will only pay taxes on them at the time of making the withdrawal. This reduces your current tax base, which translates to a lower federal tax bill.

Disadvantages of Employer-Sponsored 401k Plans

While there are many pros to investing in a 401k plan to ensure a peaceful old age, there are also some cons, including :

You will have limited investment options

Compared to other types of retirement accounts like IRAs, for example 401k accounts don’t typically offer as wide a range of investment products. You may only be able to access basic and minimal risk investments, and these will generally leave you with lower returns.

You must pay fees for early withdrawals

Another disadvantage of the 401k plan is that you will have to pay a 10% penalty if you make an early withdrawal, that is, before turning 59 and a half years of age. In addition, to this it should be added that this withdrawal is also subject to taxes. Remember that each contribution is made tax-free, that is, with deferred taxes.

Self-managed 401k plans

One of the first things to know is that self-managed investment plans tend to offer a more diverse range of investment. In addition to mutual funds, investment portfolios can be made up of exchange-traded funds (ETFs), individual stocks and bonds; this in addition to assets such as real estate properties.

When you select a self-managed program, you won’t be tied to the investment options set forth in your 401k plan. This means that you will be able to buy almost any stock, ETC or mutual fund available on the investment platform.

But can you self-manage a 401k plan? Yes. Fortunately, many companies offer the option of going through a brokerage window or choosing the self-directed plan option. This will allow you to enjoy more options as an investor, which could have certain advantages and disadvantages.

Pros of managing your own 401k investment plan

- You will have access to a wide range of investments. Instead of working with a limited number of investments, being the manager of your 401k plan you can access a wide variety of investment products.

- You can take advantage of your financial experience. If you have experience investing in funds or any other product on the market, you can put your skills to the test to grow your 401k plan balance.

- There are opportunities that could make you grow. If you’re a disciplined investor and know how to handle yourself during the most volatile market periods, you may be able to take advantage of certain opportunities to boost your retirement account balance.

- You will have non-traditional investment options. That is, buy real estate assets or expand the investments in your portfolio. These types of operations are generally not available for most 401k plans.

Cons of managing your own 401k investment plan

- There are more rules than you think. Self-managed 401k plans are governed by more laws and regulations than you might think. For example, the Internal Revenue Service prohibits certain types of investments in this plan. Those investors who are not familiar with the applicable regulations could have problems in the future and, therefore, suffer serious tax consequences.

- You may have to pay a higher fee. Investors who ditch mutual and index funds and start investing in stocks could often be forced to pay exorbitant fees that could significantly reduce their earnings.

- If you are inexperienced, it could go wrong. Amateur investors or those who do not have much knowledge of the market may have problems monitoring the performance of the trades they make. Any error would put the estimated profits in check.

- On occasion, there could be a lack of liquidity. And it is that, there are stocks, bonds and financial holdings that are not easy to sell. This, added to the risk, could have a disastrous effect.

As you can see, the management of the investment portfolio of your 401k plan could offer you the advantage of taking advantage of certain opportunities in the financial market, at least as long as you know the regulations and have experience in the investment market.

However, there are also some complexities that could reduce the amount of estimated earnings. The ideal is to choose this option only if you have sufficient experience and knowledge in the investment market.