Table of Contents

The activation of debit card before use is a fundamental step. It is a procedure that begins when the user is given the plastic and the key or PIN, indicating the bank executive or the brochure that accompanies the card, if he has received it by mail, that the activation process will be completed in 24 working hours.

In some cases it can be activated through an ATM, this being a process where the user can change the key assigned by the system or the bank executive.

In other cases, the banking institution has a telephone service to carry out this activation. It is usually a free call (0-800), whose number appears on the back of the card or is on a sticker attached to it.

In the case of the ATM, once the card is inserted the reader in the machine will read the information on the chip and through an automated process will guide the user to enter the assigned key and then modify it, with which the card will be activated.

When it comes to telephone service, an operator or an online system will require your identification and through a sequential procedure you will be asked to select certain options. For example, the system may ask you to dial 9 if the instructions you want in Spanish or 0 if it is in English, you can also ask to dial 1 if it is a credit card or 2 if it is a debit card, as is also possible ask to mark 1 if you want to activate it or 2 if your desire is to block it, and things like that.

If it is an operator who attends you, the process is more conversational and it will be enough to answer the questions that this bank employee asks you so that the card is activated at the end. These questions are usually aimed at checking your identification and the properties of the card.

As is natural in these times when online operations save time and resources, nowadays the number of banks that have an online platform to activate the card has increased.

The procedure to activate it through the web page of the bank starts with the user registration, assigning a username and password, as well as an email. Usually in the activation process a link is sent to said mail and it is enough for the user to click on it so that the card is activated.

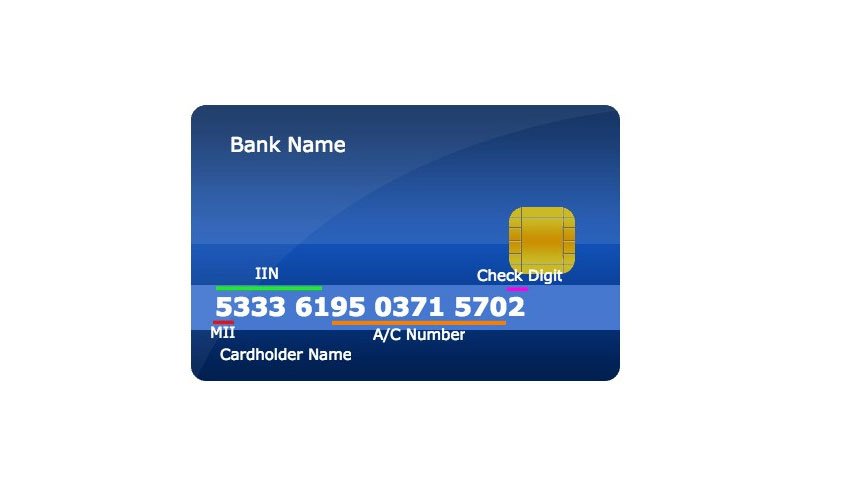

My debit card Number

Your debit card number is also known as your PAN number, and is the 16-digit number across the front of your card.

Your security number is also known as a CVV number and can be found on the signature strip on the back of your card. It will either be the last three digits of the number, or there will only be three digits on the strip.

What is the way to check if the card is activated?

In the case of telephone service, once the process is finished, the operator or banking system tells you clearly: your card has been activated.

The same happens with the online banking platform, by clicking on the link sent to the email, it sends you again to another part of the bank’s page where, in general, your card has been activated, in addition to other segments where you can review some interesting data or change your system access configuration.

If for some reason you are not convinced by the messages of having activated your card, because they said it once and it was not, then the easiest way (although not less expensive due to bank fees), that you make sure that the plastic it can already be used, it is precisely that, using it to consult, withdraw, buy or transfer. Of course, with caution, because entering a wrong password three times the card is blocked and even if you exceed several times the available funds.

What should you do after your debit card has been activated?

In addition to using it for your banking operations, obviously, now you must take care that it is not stolen or cloned, in addition to maintaining the confidentiality of your PIN and thus prevent you from being a victim of fraud or fraud.

When using your card at an ATM or when making a purchase at a commercial establishment, make sure that people can not see the numbers they make.

Many banks have a system that sends a message to your phone or your email, notifying you that you have made a banking operation using your card and if you do not know it, just click on the link that appears there. In that case verify that you were the one who made it and if the data (date, amount…) that appear there coincide with the operation performed.

If you do not have a Smartphone you may not be able to receive these types of notifications, however, some banks have taken this into account and have enabled the system to notify through the sending of text messages to conventional telephones, and to alert the banking institution about any irregularity in the operation, you should call the number that appears in the message.