Table of Contents

Checks are a necessary financial tool of modern life. Although electronic alternatives exist today, checks are still useful for sending payments by mail or keeping track of payments made. In addition, they are one of the most common payment methods when renting an apartment, paying fees or buying a vehicle.

If you want to learn how to write a check in the United States, you’ve come to the right place! This guide explains all the steps necessary to confidently write a check and issue your payments easily and securely.

What is a check?

A check is a signed document that allows the payee to withdraw a certain amount of money from the issuer’s account. It is an efficient payment method, as it is safer than cash and offers a record of the transaction.

When you give a check to another person, this document is a security. When you deposit or cash this check, the beneficiary withdraws the determined amount from your bank account without the need for you to be present to make the withdrawal.

Parts of a check

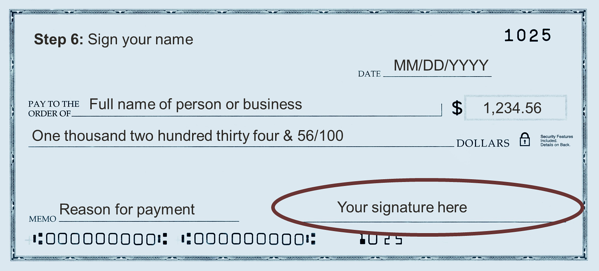

Have you ever wondered how the bank gets the data it needs to cash your checks? Although checks vary from one financial institution to another, they all have a similar format and must include the same information. With this information, your beneficiary’s bank can obtain the details of the linked account, the beneficiary, and the funds you wish to pay.

These are the parts of a check:

- Personal Information: This section includes the name and address of the account holder. The data is printed on the check.

- Date: A line to write the date the check was signed.

- Check number: The identification number of the check, which is printed on the document.

- Fractional routing number: A part of the routing number (ABA) that identifies the bank where the funds to be withdrawn are located.

- Payable to: The name of the person or company that will receive the money.

- Amount box: It is a box with the amount of the payment written in numbers.

- Check amount: The line that indicates the amount of the check written in words.

- Bank Information: This section may include your bank logo or the name and address of this financial institution.

- Memo: A short line to describe the purpose of the check.

- Signature: The line where you sign the check.

- Routing Number: Your bank’s full routing number.

- Account number: Your bank account number. With this information, the beneficiary’s bank can identify the account from which the funds should be withdrawn.

- Check number (repeated): For security reasons, the check number appears in two parts of the document. This helps prevent fraud and duplicate payments.

What you should know: The back of a check has space to endorse it. The beneficiary of the check must sign this section and include his own account number in order to deposit it or exchange it for cash.

Steps to fill out a check

Now that you’re familiar with the parts of a check, it’s time to fill in the information needed to issue your payment. Here are the steps to follow to complete this process:

1. Write the date.

The first step in writing a check is entering the date. Generally, the date of the day you issue the payment is used.

What you should know: It is important to note that checks in the United States are valid for six months. After this period, the payee cannot cash or deposit the check.

2. Write the name of the beneficiary.

Write the first and last name of the person who will cash or deposit the check. If the payee is a company, this is also where you should write the full name of the company you are paying.

What You Should Know: If you prefer not to specify a person or company, you can write a check payable to “ cash.” But this comes with a risk, as it means that anyone who gets the check can cash it.

3. Fill in the exact amount in numbers.

In the amount box, enter the exact amount of the payment. For safety, it is recommended:

- use all the space in the box to enter the numbers and avoid any alteration;

- mark the decimal point clearly;

- include cents;

- if there are no cents, add a “.00” to close the number.

What you should know: The amount written in words indicates the legal value of the check. The box with the amount in numbers is a way to verify the amount. In case of discrepancy, the amount in words is the valid amount.

4. Write the amount of money in words.

This is where you indicate the amount of money you wish to pay, using a combination of words and fractions. The fraction represents the number of cents per hundred cents.

For example, if your check is for $20.50, you would write “twenty and 50/100.” To write a check for $100.28, the amount to write is “one hundred and 28/100.” If the check is for a closed amount, such as $50, it may be written “fifty and 0/100” or “fifty and no more.”

What you need to know: Note that you do not need to write the word “dollars” as it is printed on the check. If there is space left between the written amount and the word “dollars”, it is customary to draw a line in the rest of the space. This helps prevent tampering with the check.

5. Sign the check clearly

Your signature on the check is authorization for payment and will be verified by the banks. For this reason, you must clearly sign the check. To avoid confusion, remember to use the same signature that is on file with your financial institution.

6. Write a note

The “Memo” section allows you to write a brief notation on your check. This step is optional and does not represent official information. However, it is customary to use it to facilitate your own records or the beneficiary’s records.

Some information that you can include in the annotations are:

- account number to which you are making your payment;

- receipt number you are paying;

- the reason for the payment.

How to enter a check in the check register

Once your check is ready, it is important to enter it in the register book. This is a booklet where you can write down the following important information from the check:

- check number;

- Payment date;

- description of the payment or name of the beneficiary;

- check amount.

In addition to helping you keep track of your spending, this record allows you to estimate your account balance after the payee has cashed the check. In some cases, it can take several days or even months for payees to cash a check. By keeping your register up to date, you know your exact account balance no matter when your check is deposited.

How is a check voided?

You can void a check before you make your payment or even after you’ve delivered it. As long as the check has not been deposited, there are two ways to void it. Here are the steps to follow depending on your situation.

How to void a check before handing it over

If you start to write a check and make a mistake, you can void the document. For example, if you got the amount wrong or misspelled the payee’s name, it’s best to start over with a new blank check.

However, it is important to void the check you left in the middle to avoid confusion or fraud. To void the check, you must write the word “void” in large letters across the area where the check amount is written. If you want to take even more precautions, you can write “null” in the signature section.

Remember to also enter this information in your check register. This will help you make a note of the voided check and the reason you voided it.

How to void a check after it has been delivered

In some cases, mailed checks get lost and don’t reach their recipient. It is also possible for the payee to lose the check or have their checkbook stolen. When this happens, you can call the bank to cancel one or more checks.

To stop payment on a check, you must have the following information on hand:

- your account number;

- the check number;

- the exact amount of the check;

- the date of payment;

- the name of the beneficiary.

Many banks allow you to cancel a check from their Internet portal. In some cases, you will need to do the process over the phone or in person.

If the check has not yet been deposited, the cancellation is immediate and valid for six months, since the check will expire after this period.

What you should know: Your bank may charge you a fee of up to $30 to cancel the check. In some cases, financial institutions may waive this fee if this is your first time requesting service.

Safety tips when writing a check

Being a legal document, it is advisable to take certain security measures when issuing a check. By taking the following precautions, you can avoid confusion and make your payments more efficiently:

Use Ink

Use a pen to write your checks. This ensures that all information you enter is permanent and cannot be erased.

Sign to the end

Avoid signing a check before you have written the name of the payee and the amount of the payment. This ensures that all the information is correct before making the official check with your signature.

Avoid signing Blank Checks

A blank check with your signature is an open letter so that anyone can enter the amount and beneficiary they want. If you need to make a payment but don’t know whose name it is for, wait until you have all of this information before you sign or deliver the check.

Carbon Copy

Bank statements generally include copies of any checks that cleared your account during the month. Some banking institutions allow you to view a copy of these checks from their Internet portal.

If you want to keep a copy of every check written, the best way is with a carbon copy checkbook. These offer you an immediate copy without having to wait for the payee to cash the check or for you to receive your statement.

Frequently asked questions about checks

Have more questions about how to use checks to issue payments? These are some of the most frequently asked questions about checks and their use.

Can a pencil be used to fill out a check?

Although there is no rule against using a pencil to write a check, it is always better to use a pen. Remember that pencil is easy to erase. This means that a third party can alter the name of the payee, the amount of the payment, or any other information written on the check. To avoid fraud, it’s best to use indelible ink to fill out your checks.

How do you fill out a check in English?

Checks in English must include the amount written in this language. If you write the date in words, you must also write it in English.

How do you write “50 dollars” on a check?

To write a check for $50 dollars, you must enter the amount in numbers in the corresponding box. Although it is a closed amount, remember to include the decimal point and zero cents. It is not necessary to add the dollar sign as it is printed on the check. The correct way to write it is “50.00”.

In the amount section written in words, you must also include the cents. In this case, you would write “fifty and 0/100” or “fifty and 0/100“. You also don’t need to write the type of currency here, since the word “dollars” is printed on the check. If there is space left over, you can draw a line to prevent someone else from adding information or altering the amount of the check.

What are insufficient funds?

Non-sufficient funds (NSF) occur when you pay by check for more than the balance in your account. They can also happen when you use your debit card to pay for a transaction that is more than your available balance.

If your account has overdraft protection, your bank may cover these charges to prevent your payments from bouncing. However, the cost of this protection is usually between $25 and $35 per transaction.

To avoid insufficient funds, it’s best to check your account balance before writing a check or making a payment with your debit card. With your check register, you can keep better track of your finances and keep your balance on hand at all times.

Is it possible to write checks for yourself?

Yes, you can write a check to yourself to deposit funds into another bank account. In this way, you avoid carrying cash and can keep track of your movements from one account to another.

What happens if I make a mistake when filling out a check?

Depending on the mistake you made, you may be able to correct it or void the check. If you make a mistake when writing the name of the beneficiary, the date or the amount in numbers, you can correct it and add your initials. This indicates that it was you who made the change yourself and that you authorized the check.

What you should know: The amount written in words and the signature are the official sections of the check. If the error occurred in either of these two parts, you should void the check and write another one.

Feel confident writing a check

Although electronic transactions are becoming more common, situations always arise that require a physical check. In these cases, it’s important to know how to write a check the right way. This will help you process your payments and keep track of your spending.