Table of Contents

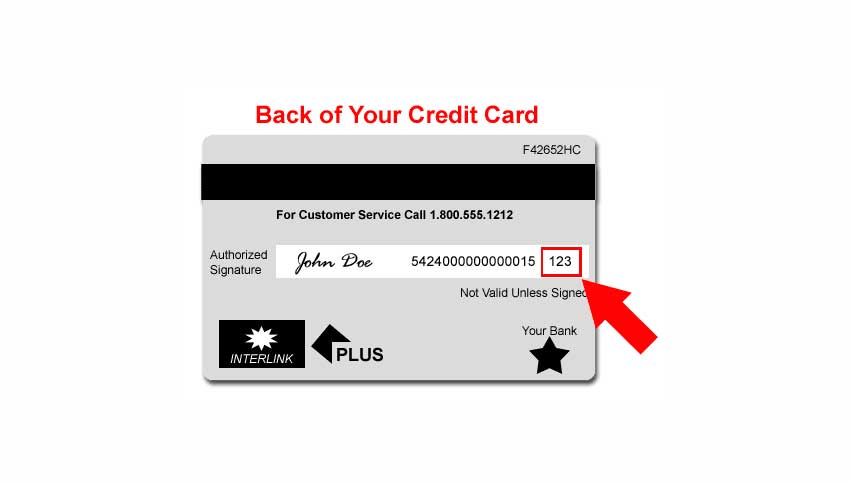

The use of credit cards has become almost ubiquitous. Consumers use credit cards at service stations and supermarkets, make online purchases and confirm the information by phone. Many customers are familiar with mentioning or writing the 16 digits of their card, but many vendors today request another number, the three-digit code on the back of your card; This works as another protection against fraud, so keep it carefully.

Definition

The three-digit code on the back of the credit card is also known as the “CVV2 code” or “verification code.” On American Express cards, this code appears on the front. The three-digit codes are not magnetized, so they are not scanned when passed through the payment slot. Merchants cannot save these codes.

Purpose

Three-digit credit cards have a key purpose: to protect consumers from fraud. When making a purchase in person, merchants take precautions to ensure that the person using the card is the owner, for this, they ask for their identification. If you make a purchase online or by phone, merchants cannot easily verify whether or not the customer is the rightful owner. To protect them from fraud, merchants request the three-digit code as a form of verification that the person making the purchase has the card in hand. A criminal who found out your credit card number by snooping your mailbox or spying on you at the supermarket, you cannot easily learn the three-digit secret code, because it is located on the back of the card, since it also does not appear in your account information and is not monitored along with your credit card number at the cash register. A criminal who tries to use your credit card number in an online or telephone transaction may try to guess what your three-digit number is, but incorrect attempts can cause the purchase to be rejected.

Fraud

Criminals often follow security innovations closely with new techniques to perpetrate fraud. In this case, it is possible that consumers may be deceived by sharing their code when criminals contact them by posing as company representatives. Your company already knows your account number, so if they call you legitimately, they will not ask for your account information.

Protection

If you receive a phone call from someone who pretends to be a representative of a credit card company that asks for the three-digit code, hang up. Call your company to verify if someone has tried to contact you; If the contact was legitimate, there will be a record of the call and they will explain why they called you. Never reply to emails that ask for information about your card or click on links that are supposed to direct you to the company’s website; Instead, contact the company directly. Report suspected fraud when this happens; This can help the corresponding agencies to catch criminals.